Look forward about a year and visualize the man pulling up to the portico of the Ritz-Carleton in Boston in his new Jaguar.

The Tata Group already owns the Boston Ritz. If it has its way, by next year it may also own Jaguar and Land Rover. Tata Group has publicly said they’re interested in bidding on the Jaguar and Land Rover, which are currently owned by Ford Motor Company.

Tata Group, as the name implies, is a conglomerate. It is the largest conglomerate in India, with annual revenues over $20 billion and a market capitalization of $56 billion. That later figure, which represents the market value of all of Tata’s publicly traded stock, is somewhat misleading. Only about one-fourth of the companies included within the Tata Group are publicly traded, so the market capitalization figure substantially understates the true worth of the Group.

Tata got its start in textiles. Its founder, Jamshedji Tata, turned textiles into a fortune, and then expanded into hotels, which are now the Taj hotel chain. From there, Tata went into steel, with what’s now Tata Steel. The steel operation was vertically integrated. That is, Tata not only owned the steel mills, but it also owned the mines that produce the coal and iron necessary to make the steel. The result was low cost production that continues to allow Tata to undersell its competitors today. Tata also expanded into hydroelectric power, setting up the Tata Hydro-Electric Power Supply Company.

To get a sense of how rapidly Tata grew, consider this timeline: Tata opened its first hotel in 1903. By 1912, had already organized the hydro-electric company and was opening its first steel plant.

Tata continued to expand, entering the consumer goods industry, starting an airline – which is now Air India – and entering the chemicals business. Today, it also operates insurance and financial services companies, publishing companies, computer, telecommunications and software companies.

It also manufactures automobiles.

In 1945, Tata Motors was established to manufacture locomotives. It is now India’s third biggest auto manufacturer. Its automotive presence, however, isn’t limited to building cars. It is a leading supplier of parts to other manufacturers, through the Tata Autocomp Systems Ltd. It dominates the heavy truck market in India, accounting for 70% of the vehicles sold.

Tata’s recent growth is the work of its current chairman, Ratan N. Tata, who assumed that position in 1991. In the rapid expansion of the company which followed, he was aided by a series of economic reforms implemented by the government that same year, including some which restricted the operation of foreign owned companies in India. The Indian economy grew rapidly and Tata grew exponentially. In the fifteen years that followed, Tata revenues increased six times over the 1991 level.

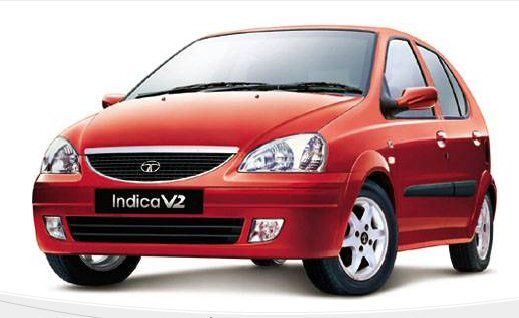

Tata Motors entered the passenger car market in 1995. In 1998, Tata introduced the first car completely designed, engineered, and manufactured in India: the Indica, pictured here. It has become one of the best selling brands in the country, priced at about $7,000. But Tata has plans for an even bigger seller. Perhaps as early as next year, Tata will introduce a four-door rear-engine car approximately the size of a Volkwagen Rabbit and selling in India for $2,200.

In an interview given to Forbes magazine in 2005, Tata’s chairman made no secret of his companies’ aspirations: it wants to continue to grow in India, but it also wants to expand into foreign markets. Since that interview was given, Tata has done just that: in 2006, Tata acquired companies as diverse as the manufacturer of Eight O’Clock Coffee and Corus Steel of Britain. Joined with Tata Steel, that created the fifth largest steelmaker in the world.

Tata also bought the Boston Ritz-Carleton in 2006.

If Tata acquires Jaguar/Land Rover, it won’t be the first time they’ve acquired a failing vehicle manufacturer and made it profitable. Tata owns Daewoo Trucks. (GM owns the Daewoo auto operation.) According to Ratan Tata, “We saw an opportunity in an entity that had a certain market share, that had a product line that we did not have, and that was a strategic fit for us. We brought in our marketing reach and made the company more profitable.”

Ratan Tata told Forbes that “hen you visit a country or examine a particular company, I think you intuitively known if there’s an opportunity, and then you flesh out that opportunity in one form or another.”

Apparently, Tata sees opportunity in Jaguar and Land Rover which Ford missed. They are probably right. Ford has invested heavily in Jaguar. It has built and equipped new plants, and a new headquarters, eliminated the long-standing reputation of the Jaguar brand for unreliable products and built a strong dealer network. Jaguar is a presence in a market segment which can provide high profit margins for every car sold. Whoever buys Jaguar and Land Rover will be acquiring all that Ford has invested for a very low price.

Jaguar seems to fit Ratan Tata’s idea of an “opportunity.”