That’s the word from John Fleming, the President of Ford of Europe, according to an interview he gave earlier this week to the Spanish daily newspaper el Mundo. “We are moving forward and within two months at the most, we will know which of the bidders will be the new owner of the two brands." He also said that Jaguar and Land Rover would be sold as a package deal.

"Both are closely linked and it would be difficult to sell them separately."

So which of the five bidders will be the winner?

And at what price?

Here’s the fearless prediction: Tata, for about $1.2 billion.

The key is the engine supply. Neither Jaguar nor Land Rover own their own engine production facilities. Their engines are made by Ford and the facilities that build those engines are not part of the proposed sale. No matter what assurances Ford may give to the buyer about maintaining engine supply, the bottom line is that the owner of Jaguar and Land Rover will either remain perpetually dependent on Ford, will be faced with a very large investment to build its own engines, or will have to find some other company from which to buy engines.

That fact is not likely to be lost on those to whom any of the other bidders must look for the money to finance a buy-out, and it makes the deal even less attractive as an investment. It puts Jaguar and Land Rover in an even more uncompetitive position as the years go buy and the engines need development or improvement or, eventually, replacement with a new and better design.

Tata doesn’t have that problem. It already builds both cars and trucks. It has facilities to build engines and engineers to design them. It also, of course, has a very large footprint in one of the most rapidly growing automotive markets – India, its home.

To insure that Ford would remain cooperative on engine supply, any buyer would need to require Ford to retain an interest in the company – say, 20% as did Daimler when it sold the Chrysler to Cerberus. But that isn’t what Ford wants. It cuts down the price it receives and leaves it exposed to the possibility that it would have to pump in more money, at some point, as part owner.

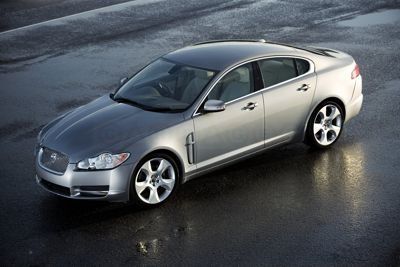

Jaguar has never been a strong brand and it has never had a good reputation. In the two decades after World War II, its name signified sports cars of incredible beauty and sedans of unequaled unreliability. As German brands were building their brand identities in the United States, Jaguar was struggling with archaic unions in Great Britain, several ill-conceived mergers of British auto manufacturers (none of whom had any money), and a weak dealer network. Ford’s purchase never overcame that legacy, partly because Jaguar’s position forced it to build a better car before it had any real hope of breaking into the market.

Jaguar’s best bet, as a brand, is to attempt to establish itself as a leading brand in markets which don’t already have fixed brand images set by the competition. Tata is ideally situated to do so, merely by building on the company structure already in place. Any other buyer will lack those advantages.

Ultimately, though, this is a deal which Tata can easily walk away from. It knows how much it is willing to pay, and what it is willing to pay is a very good indication of what Jaguar is worth. Ultimately, the investors who might have to finance the deal for some other buyer are likely to consider that they would be financing a deal to pay more than Tata was willing to pay. And that’s likely to give them pause about whether the deal is one they want to risk putting their money into.

In the end, Tata is the only possible buyer.

Anyway, at least that’s my prediction.