Toyota has developed a new type of magnet that relies less on neodymium, a rare earth metal that’s used in the world’s most powerful permanent magnets, including those that are used in motors for electric cars. According to the Japanese automaker, the new magnet has 20 percent less neodymium in them, lessening the reliance on the precious metal as the production of hybrid and electric cars ramp up in the coming years. It is believed that lessening the reliance on neodymium will go a long way in cutting down the costs of producing electric cars.

Despite being described as a fairly common element that’s no rarer than cobalt, nickel, or copper, the supply of neodymium could be at risk in the future if it’s continually used in a lot of industries. That doesn’t even count the auto industry, which could jump to the top of the list of industries that will deplete the supply of neodymium. According to Akira Kato, general project manager at Toyota's advanced R&D and engineering company, the risk of a supply shortage of the metal is possible. "An increase in electric car production will raise the need for motors, which will result in higher demand for neodymium down the line," he said, in a press conference in Tokyo. "If we continue to use neodymium at this pace we'll eventually experience a supply shortage ... so we wanted to come up with technology which would help conserve neodymium stocks."

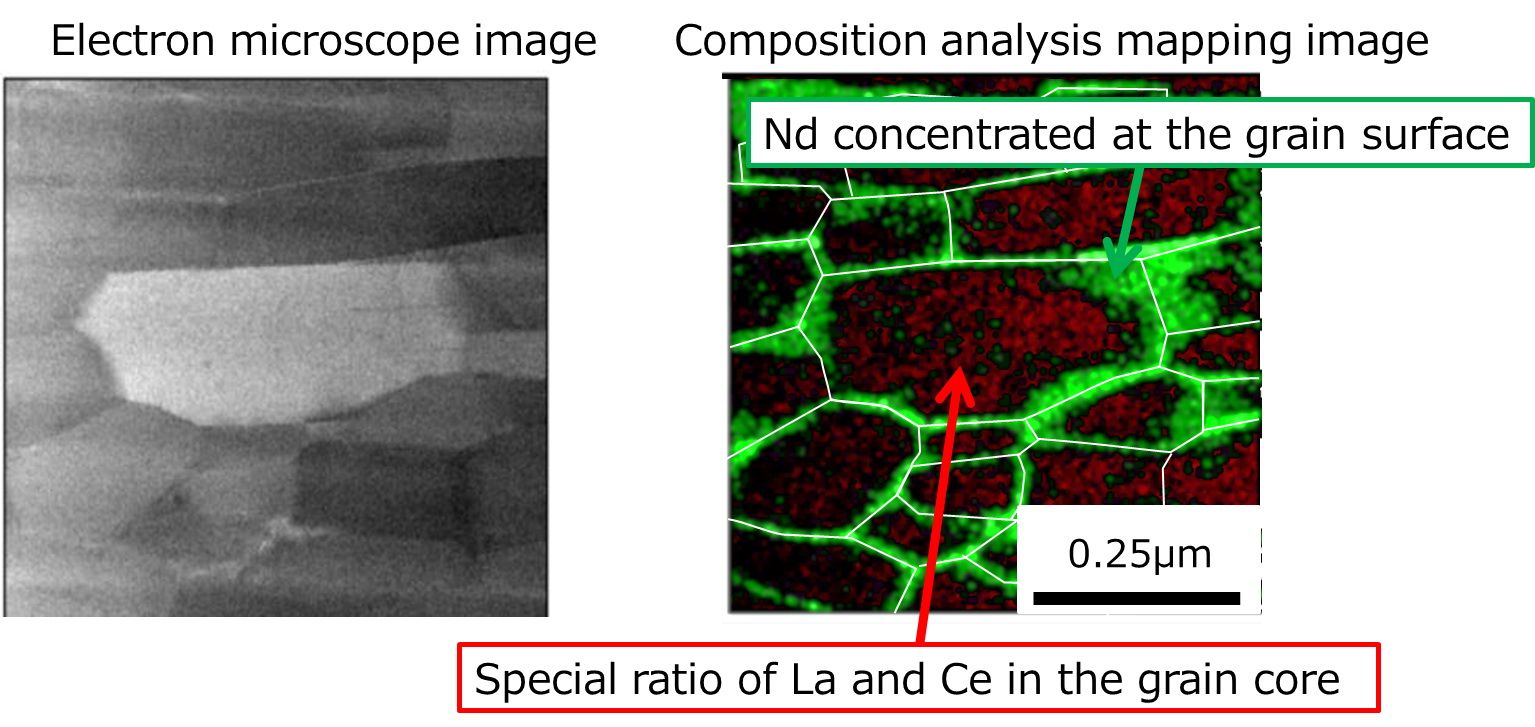

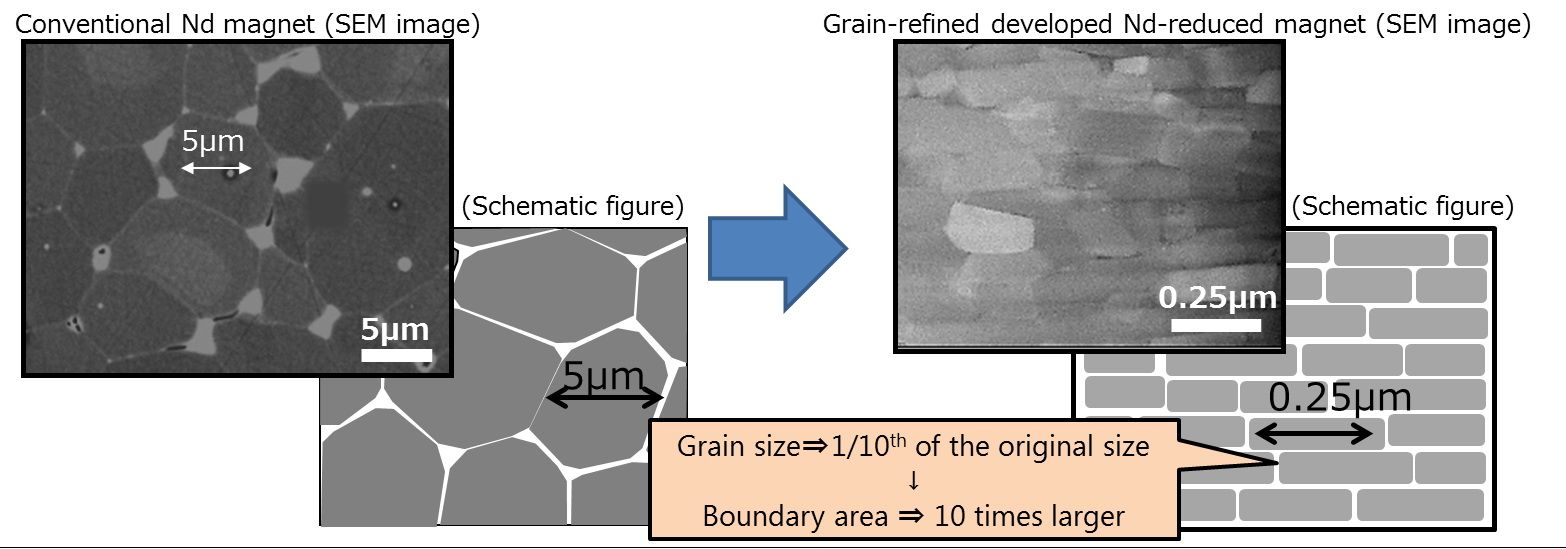

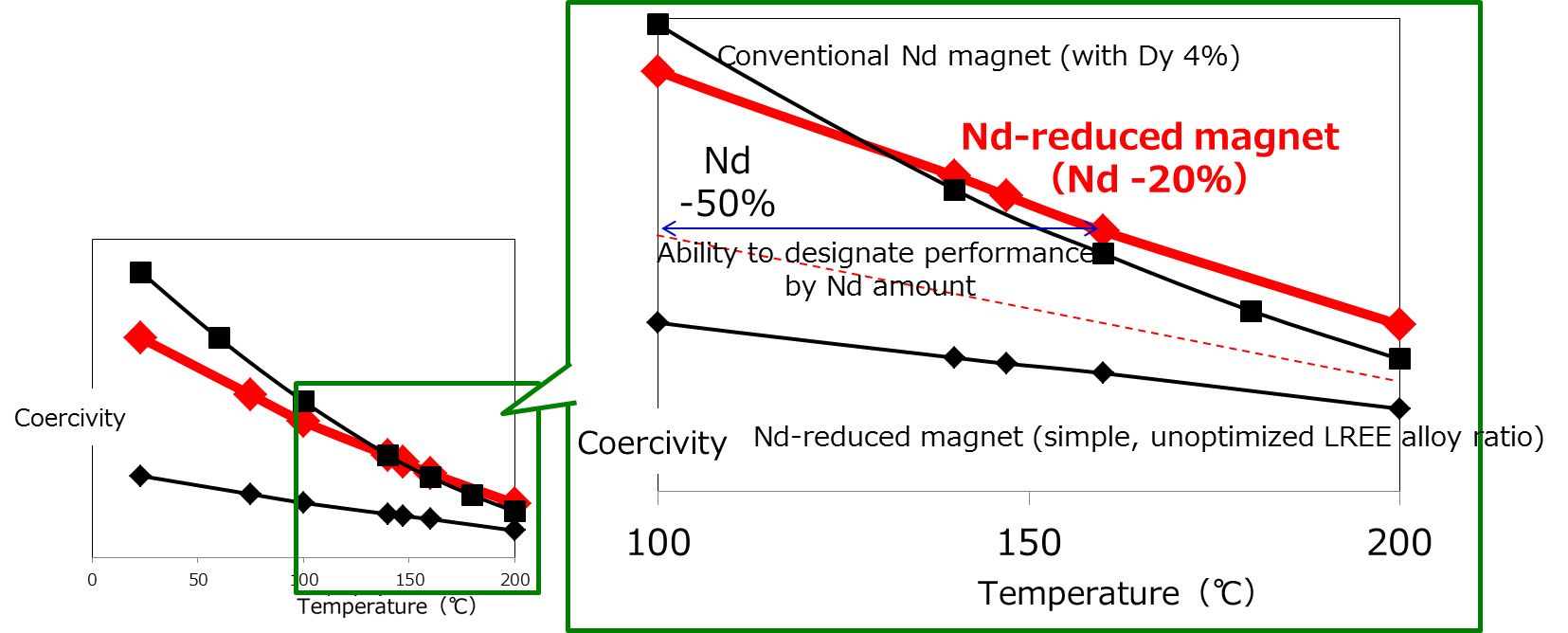

The technology Kato is referring to in creating these magnets for electric car motors involves less use of neodymium and more lanthanum and cerium, two metals that are cheaper and more abundant these days. The move to decrease and, hopefully, eliminate the use of neodymium on the magnets used to operate motors for hybrid and other electric motors comes at a point where automakers are beginning to develop new ways to re-engineer the production of the magnets.

For its part, Honda has found ways to eliminate dysprosium and terbium from magnets because they’re more expensive than neodymium. Dysprosium and terbium are a lot like neodymium in the sense that they’re heavily used in the development of magnets. For comparison’s sake, a kilo of neodymium costs around $100. A kilo of dysprosium costs $400. Then there’s terbium, which costs $900 per kilo.

Compare those prices to lanthanum and cerium — $5 to $7 per kilo — and you see why automakers like Toyota and Honda are putting a lot of their time and money into developing magnets that cost less to produce. As production of hybrid and electric cars continues to increase, automakers are being put in a position wherein they have to take action and address the potential of a shortage supply of these metals.

References

Read more Toyota news.

Read more technology news.