The ongoing COVID-19 pandemic had mixed effects on the auto industry. A shortage in semiconductors has led manufacturers to do strange things. BMW, for instance even removed touch screens on some of their models as a way to steer through the pandemic, while some brands such as General Motors outright sold fewer cars this year, surrendering its crown to Toyota as America's best-selling automaker after a 90-year dominance. As a result, a number of new car buyers migrated towards the used car market, which also has led to a thin inventory of used cars.

But as the global supply of chips and the demand for cars both stabilize, expect a "bloodbath" in prices to happen in the used car market in the coming year into 2023. This is what Cathie Wood, the star fund manager and chief executive of ARK Invest, in a Tuesday monthly market update stated, as first reported by MarketWatch.

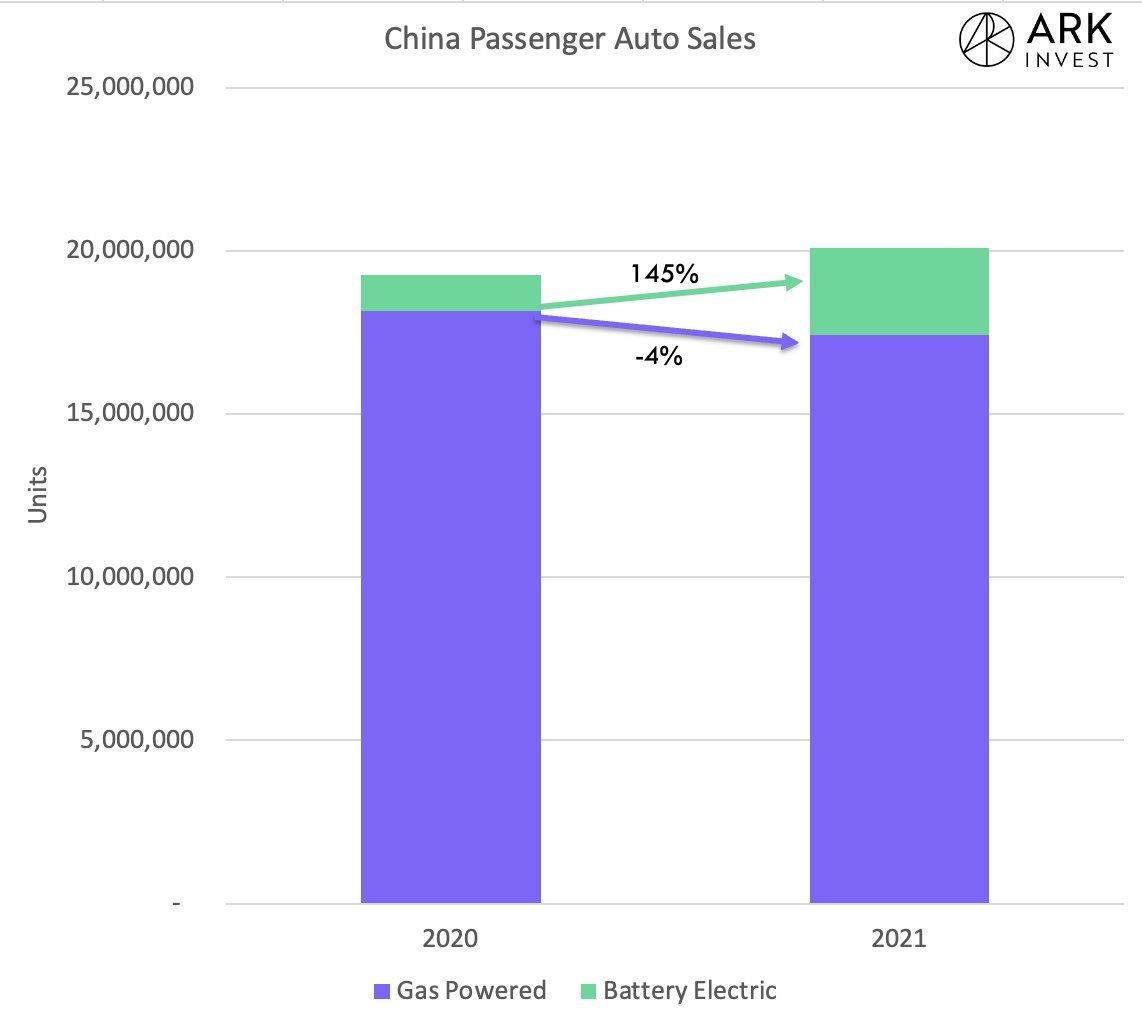

Speaking of electric vehicles (EVs), Wood tweeted that China's automotive market showcases the upcoming shift towards EVs. While their overall automotive sales have grown, sales of internal combustion engine (ICE) vehicles have actually declined.

China's shifting preferences towards EVs could also be a reflection of what is to come for the U.S. Earlier this week, Wood also said that in the U.S., electric vehicles currently have a 2 percent market share, adding that what if the other 98% or so are on their way out as the consumer preference shifts toward electric.

Because of this, Wood thinks that depressed consumer sentiment, rising inventories of used cars, and alleviation of the microchip shortage, are signs that the new-vehicle sales plunge that has yet to recover isn’t due to supply issues. Wood recently said in her tweet that sales of gas-powered cars in the U.S. are likely to struggle as used car inventories stabilize and continue to recover.

Do you think that Cathie Wood's predictions are right? Will we definitely see a crash in used car values this year? Are EVs soon going to overtake sales of ICE vehicles? If so, then this might be a good time to sell your pre-owned vehicle and earn a good amount of money from it.