What do all electric vehicle manufacturers need and is difficult to come by? That's right, batteries. But while most established automakers are just planning their first battery factories, or at least will be able to start them up soon, demand for their electric models continues to grow rampantly. So if they are not yet able to supply themselves, the question automatically arises as to how they are going to provide the urgently needed supply of batteries. This is where some suppliers come into play who are already a step ahead of the car manufacturers in battery cell production. This is exactly the kind of cooperation Hyundai and SK On have now announced so that both companies can benefit from the Inflation Reduction Act in the United States.

Hyundai And SK On Cooperate On Battery Cells

According to information from Reuters, Hyundai and SK On have reached an agreement after the Korean automaker will purchase batteries for its electric vehicles produced in North America from SK On. This agreement comes in light of the Inflation Reduction Act, which requires automakers to source a certain percentage of critical minerals for their EV batteries from the United States or a U.S. free-trade partner in order to qualify for new federal EV tax credits.

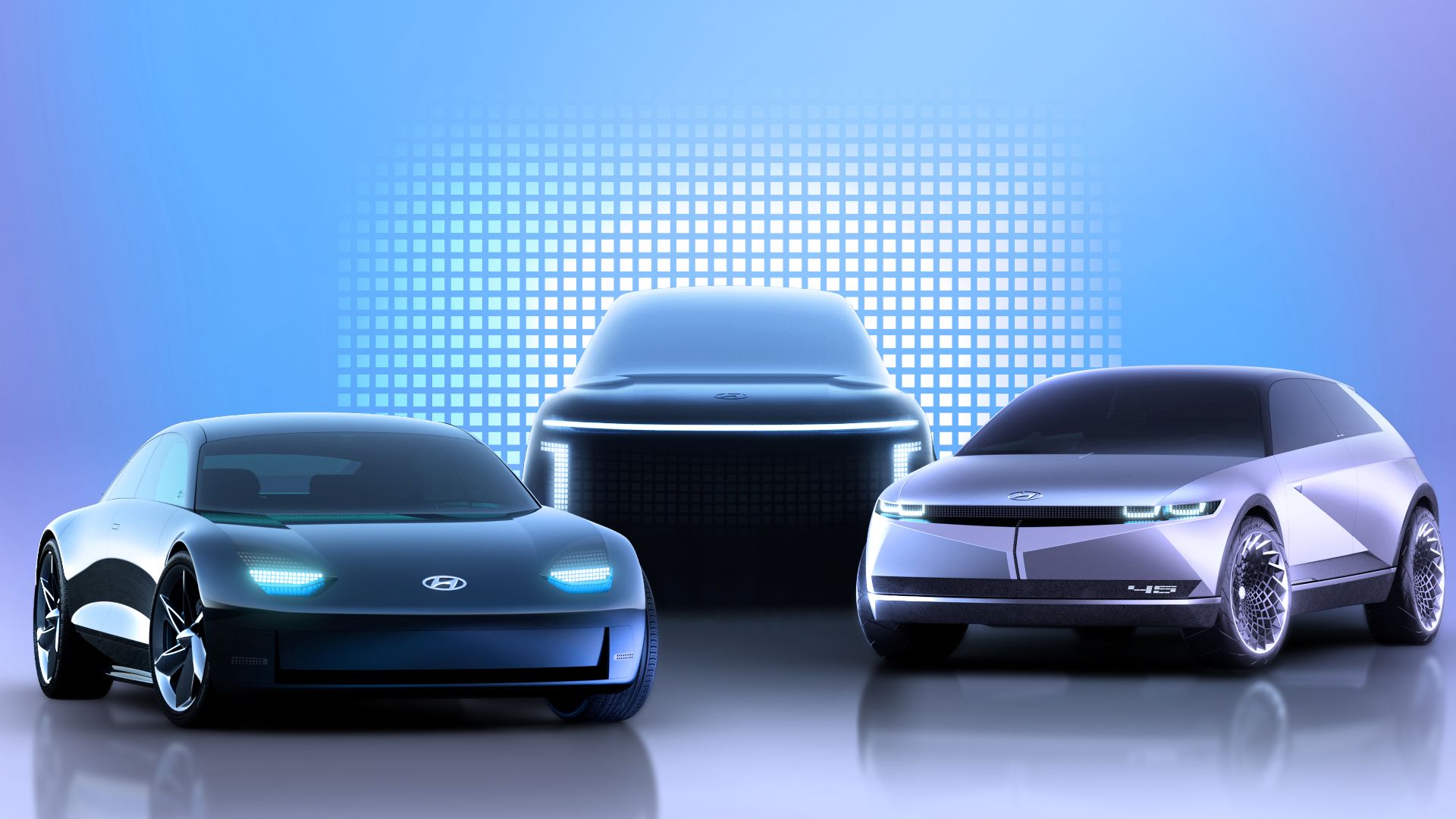

Accordingly, starting in 2025, SK On will provide its batteries to Hyundai in the United States for the production of electric vehicles so that both companies can better meet the required qualifications for tax credits. A plant is also under construction in the U.S. state of Georgia to produce these all-electric models from Hyundai and Kia, which is expected to produce up to 300,000 units starting in the first half of 2025. In addition, however, Hyundai is also considering starting production of electric vehicles earlier at its current U.S. plants to benefit longer from U.S. tax credits, according to the Korean Ministry of Commerce.

The Inflation Reduction Act

Under the Inflation Reduction Act, enacted in August, at least 40% of the minerals used in batteries must come from the United States or a U.S. free trade partner starting in 2023 to qualify for electric vehicle tax credits of up to $7,500. That figure is expected to rise as high as 80% by 2027. In addition, the legislation, which passed by a narrow margin, requires electric vehicles to be assembled in North America to qualify for tax credits. Hyundai and Kia, as well as some European automakers, have therefore been excluded from the subsidies so far, as they do not currently produce the electric models in question in the United States.